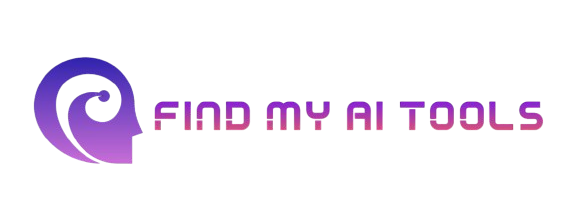

TigerGPT (Investment AI) is a sophisticated financial technology platform that leverages advanced artificial intelligence to provide comprehensive investment analysis, portfolio management, and predictive insights. By processing vast amounts of financial data and employing machine learning algorithms, TigerGPT empowers investors to make informed decisions and optimize their investment strategies.

Tags:AI Finance Investment Technology TradingTigerGPT Product Information

What's TigerGPT?

TigerGPT (Investment AI) is a sophisticated financial technology platform that leverages advanced artificial intelligence to provide comprehensive investment analysis, portfolio management, and predictive insights. By processing vast amounts of financial data and employing machine learning algorithms, TigerGPT empowers investors to make informed decisions and optimize their investment strategies.

How to use TigerGPT?

- Create a TigerGPT account and connect existing investment portfolios.

- Define investment goals, risk tolerance, and time horizon.

- Utilize AI-powered tools for market analysis, stock screening, and portfolio optimization.

- Receive personalized investment recommendations and alerts.

- Monitor portfolio performance and make data-driven adjustments.

Key Features of TigerGPT

♥ Market Sentiment Analysis: Gauges investor sentiment towards specific stocks, industries, or the overall market.

♥ Risk Profiling: Assesses an investor's risk tolerance and recommends suitable investment options.

♥ Portfolio Rebalancing: Suggests adjustments to maintain optimal asset allocation.

♥ Alternative Investment Analysis: Provides insights into asset classes beyond traditional stocks and bonds.

♥ Robo-Advisory: Offers automated investment management services based on user preferences.

Use Cases of TigerGPT

- Identifying undervalued stocks with high growth potential.

- Constructing diversified portfolios to mitigate risk.

- Making informed decisions during market volatility.

- Evaluating investment performance against benchmarks.

- Exploring alternative investment opportunities.

Pros

- Advanced predictive analytics for forecasting market trends and identifying investment opportunities.

- Comprehensive portfolio analysis and optimization based on user-defined goals.

- Real-time market data and news feeds for informed decision-making.

Cons

- Relies heavily on the accuracy and completeness of input data.

- Investment decisions ultimately involve human judgment and discretion.

- Potential for algorithm biases if not carefully calibrated.

FAQ of TigerGPT

Q: Does TigerGPT (Investment AI) guarantee investment profits?

A: No, investment involves risks, and past performance is not indicative of future results. TigerGPT provides tools to assist in decision-making.

Q: How often is the data updated?

A: TigerGPT utilizes real-time market data to provide up-to-date insights and recommendations.

Q: Can TigerGPT be used for day trading?

A: While TigerGPT can provide data-driven insights, day trading involves high risk and is not recommended for all investors.

Q: What kind of security measures are in place to protect user data?

A: TigerGPT employs robust security measures to safeguard user data and financial information.

Q: How does TigerGPT handle personal financial information?

A: TigerGPT uses personal financial information to tailor investment recommendations but maintains strict privacy policies.

Relevant Navigation

ElevenLabs is a cutting-edge AI platform specializing in generating and optimizing high-quality text-to-speech and voice synthesis. It uses advanced machine learning models to create lifelike and natural-sounding voices for various applications, including virtual assistants, audiobooks, and interactive media. ElevenLabs offers customizable voice options and real-time speech generation, making it a valuable tool for businesses and content creators looking to enhance user engagement and accessibility. Its innovative technology ensures that generated voices are clear, expressive, and closely mimic human speech patterns.

Adobe AI is a comprehensive suite of artificial intelligence tools integrated into Adobe's Creative Cloud, designed to enhance creativity, productivity, and design capabilities. By leveraging advanced machine learning and computer vision, Adobe AI empowers users to achieve professional-quality results across various creative applications.

Deepnews is an advanced AI-powered news aggregation and analysis platform that delivers comprehensive and personalized news content. By leveraging natural language processing and machine learning, Deepnews curates relevant news articles, identifies key information, and provides insightful summaries.

Gemini is a highly advanced AI model developed by Google AI. It excels in a wide range of tasks, including text generation, translation, coding, and even generating different creative content formats. Designed to be versatile and adaptable, Gemini pushes the boundaries of what AI can achieve.